colorado estate tax rate

Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. You can sort by any column available by clicking the arrows in the header row.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Property Owner Address Change.

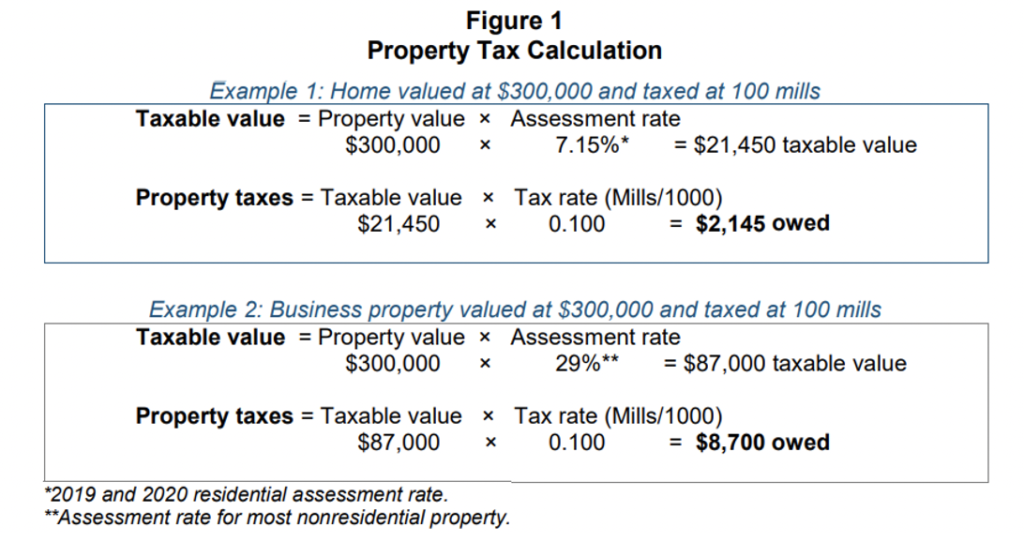

. Property Taxes and Property Tax Rates Property tax rates are set by each county. Median property tax is 143700 This interactive table ranks Colorados counties by median property tax in dollars percentage of home value and percentage of median income. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000.

If the asset value exceeds the exemption amount there can be a significant estate tax at rates between 35 and 55. There are jurisdictions that collect local income taxes. Get information on property taxes including paying property taxes and property tax relief programs.

For an 8 million ski cabin with a mill levy of 3406 for example annual property taxes would be 1893736calculated by multiplying 695 of 8 million which equals 556000. They will average around half of 1 of assessed value. Property Tax Information Search for real and personal property tax records find out when property tax payments are due accepted payment methods tax lien sales and property tax rebate programs offered by the City and County of Denver.

Colorado charges sales taxes from 29 to 15. Oak Street Fort Collins CO 80521 Map of Facilities 970 498-7000 Contact Us Our Guiding Principles. The Colorado Income Tax Colorado collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Estate tax revenue is subject to the spending and revenue limitations of TABOR. Tax Rate The Colorado estate tax is based on the state death tax credit which until 2005 was allowable on federal estate tax returns. Federal Estate Tax Exemptions For 2022.

Of these states Maryland imposes both taxes. 2 days ago- Average property taxes in 2020. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment.

A federal estate tax return can be filed using Form 706. For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income.

State wide sales tax in Colorado is limited to 29. However if the decedent owned any sort of real property the estate must apply for normal probate. Property taxes in Colorado are definitely on the low end.

Colorado also has a 290 percent state sales tax rate a max local sales tax rate of 830 percent and an average combined state and local sales tax rate of 777 percent. Estate INCOME Tax Estate income. Unlike the Federal Income Tax Colorados state income tax does not provide couples filing jointly with expanded income tax brackets.

State Comparisons In 2020 11 states plus Washing DC levy estate taxes and six states levy inheritance taxes. Colorado imposes a sales tax rate of 290 percent while localities charge 475 percent for a combined 7. May increase with cost of living adjustments.

Estate tax can be very complicated. Coloradans will receive a tax rebate of 750 for individual filers and 1500 for joint filers beginning in August 2022. But when you add any local taxes they can get up closer to 8.

1693 --- up 143 The median single family home value in Colorado Springs hit a new record-high in May 2022 after seven straight years of. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Colorado has no estate tax for decedents whose date of death is on or after January 1 2005.

How To Claim Your Colorado Cash Back Retailers Begin Collecting the Retail Delivery Fee on July 1st. Requirements for Eligibility Applicant must be a senior who is 65 years or older or a person called into military service pursuant to CRS 39-35-101 18 on January 1 of. While federal law still imposes estate taxes on certain estates only about two of every 1000 people who pass away or 02 percent have to pay any taxes at all.

The loan is logged as a lien against the participants property that does not have to be remitted until the participant no longer qualifies to defer their property taxes. Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim this. The list is sorted by median property tax in dollars by default.

Colorado has a flat 455 percent state individual income tax rate. Colorado sales tax rate. Colorado is ranked number thirty out of the fifty states in order of the average amount of property taxes collected.

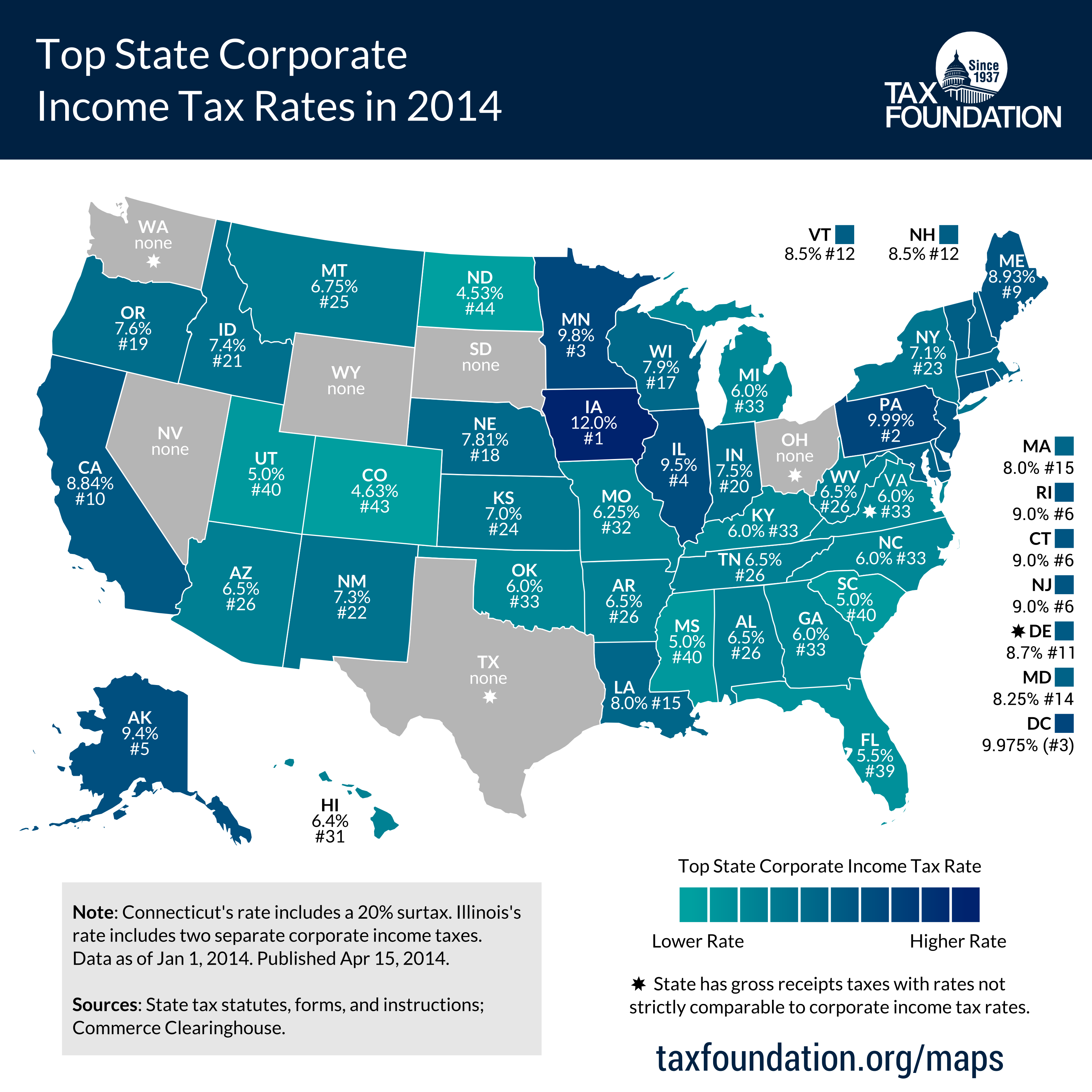

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Colorado has a 455 percent corporate income tax rate. If you are considering moving there or only planning to invest in Colorado real estate youll learn whether Colorado property tax regulations are helpful for you or youd rather.

With our guide you will learn valuable facts about Colorado real estate taxes and get a better understanding of things to consider when you have to pay the bill. Counties in Colorado collect an average of 06 of a propertys assesed fair market value as property tax per year. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws.

Make sure you have engaged an attorney or CPA to limit any tax that you have to pay. Capital Gains Taxes Colorado allows taxpayers to subtract certain.

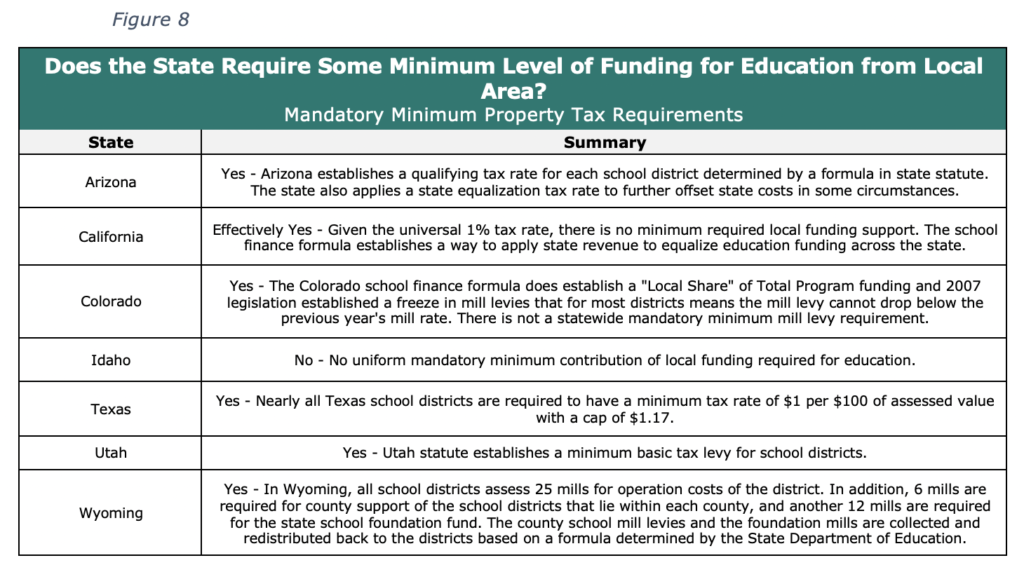

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

Individual Income Tax Colorado General Assembly

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Top State Corporate Income Tax Rates In 2014 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Do I Need To Worry Brestel Bucar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Colorado Estate Tax Everything You Need To Know Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Colorado Estate Tax Everything You Need To Know Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute